The Competitive Edge: How Airbnb Utilised Counter Positioning

GET THE #1 EMAIL FOR EXECUTIVES

Subscribe to get the weekly email newsletter loved by 1000+ executives. It's FREE!

Introduction

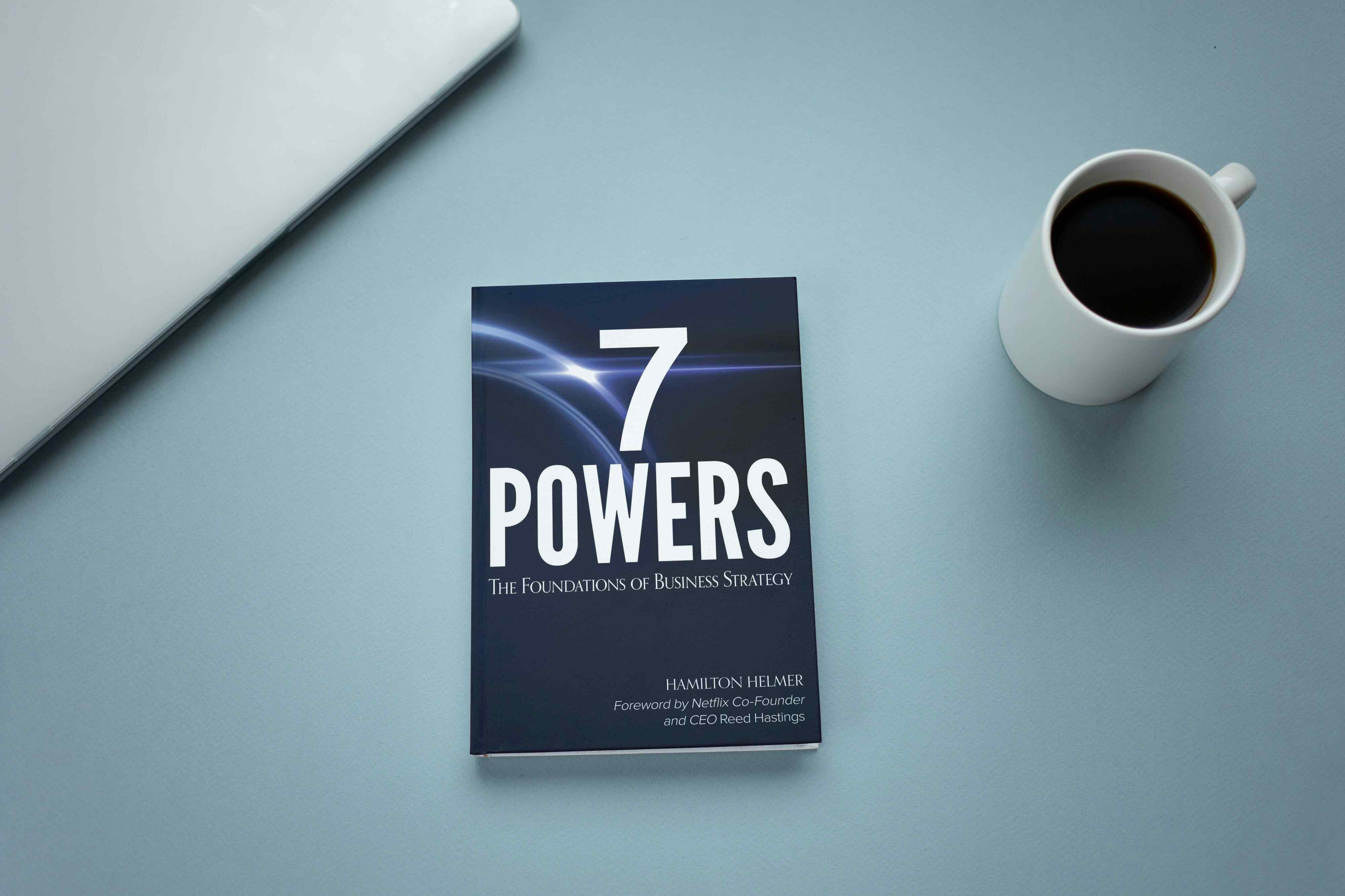

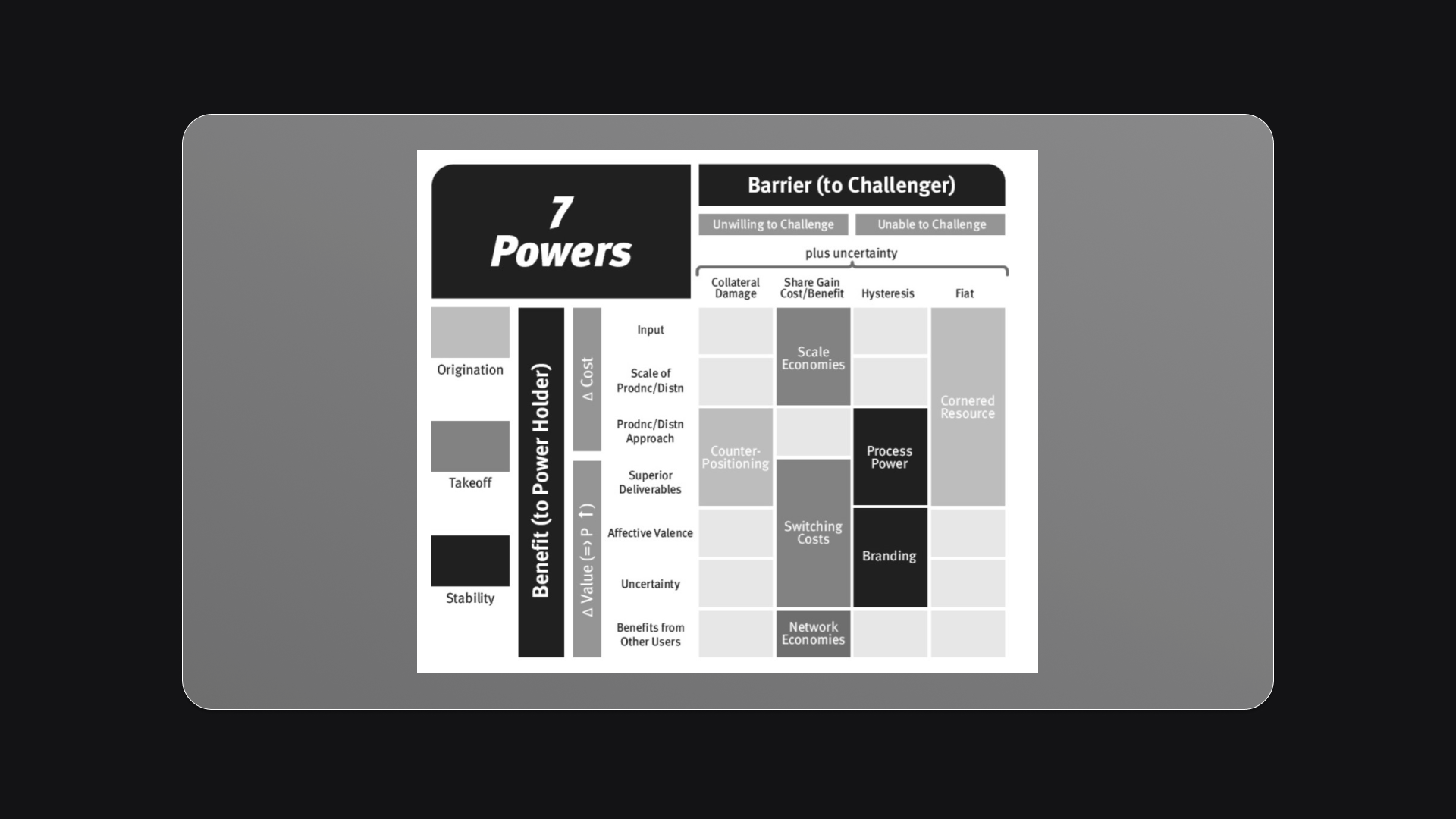

As part of this new series, I want to revist the 7 Powers book by Hamilton Helmer and apply the principles to real world examples. In this article, we will explore how Airbnb's rise to power can be analyzed using the 7 Powers framework.

I'm doing this because I found that it was the book that had the most impact on me in terms of understanding how businesses can create long-term value. I'm constantly recommending this book when we are consulting with clients.

Counter Positioning

Counter positioning is a strategy that involves offering a new product or service that is different from what is currently available in the market. This can be done by offering a product that is cheaper, faster, or better than what is currently available.

This is one of the 7 powers that Hamilton Helmer talks about in his book. The 7 powers are counter positioning, cornered resource, scale economies, network economies, switching costs, branding, and process power.

Counter positioning is interesting because it exists in the origination stage of a business. This is the stage where a business is just starting out and is trying to find a foothold in the market. Counter positioning is a powerful strategy because it allows a business to differentiate itself from its competitors and create a unique value proposition for its customers.

Power 1 - Counter Positioning

Definition

Counter positioning is a strategy that involves offering a new product or service that is different from what is currently available in the market. This can be done by offering a product that is cheaper, faster, or better than what is currently available.

Benefit

The new business model is superior to the existing model due to lower costs and or the ability to charge higher prices.

Barrier

The barrier is interesting, essentially it is irrational for the incumbent to adopt the new model because it would destroy their existing business model.

Airbnb Example

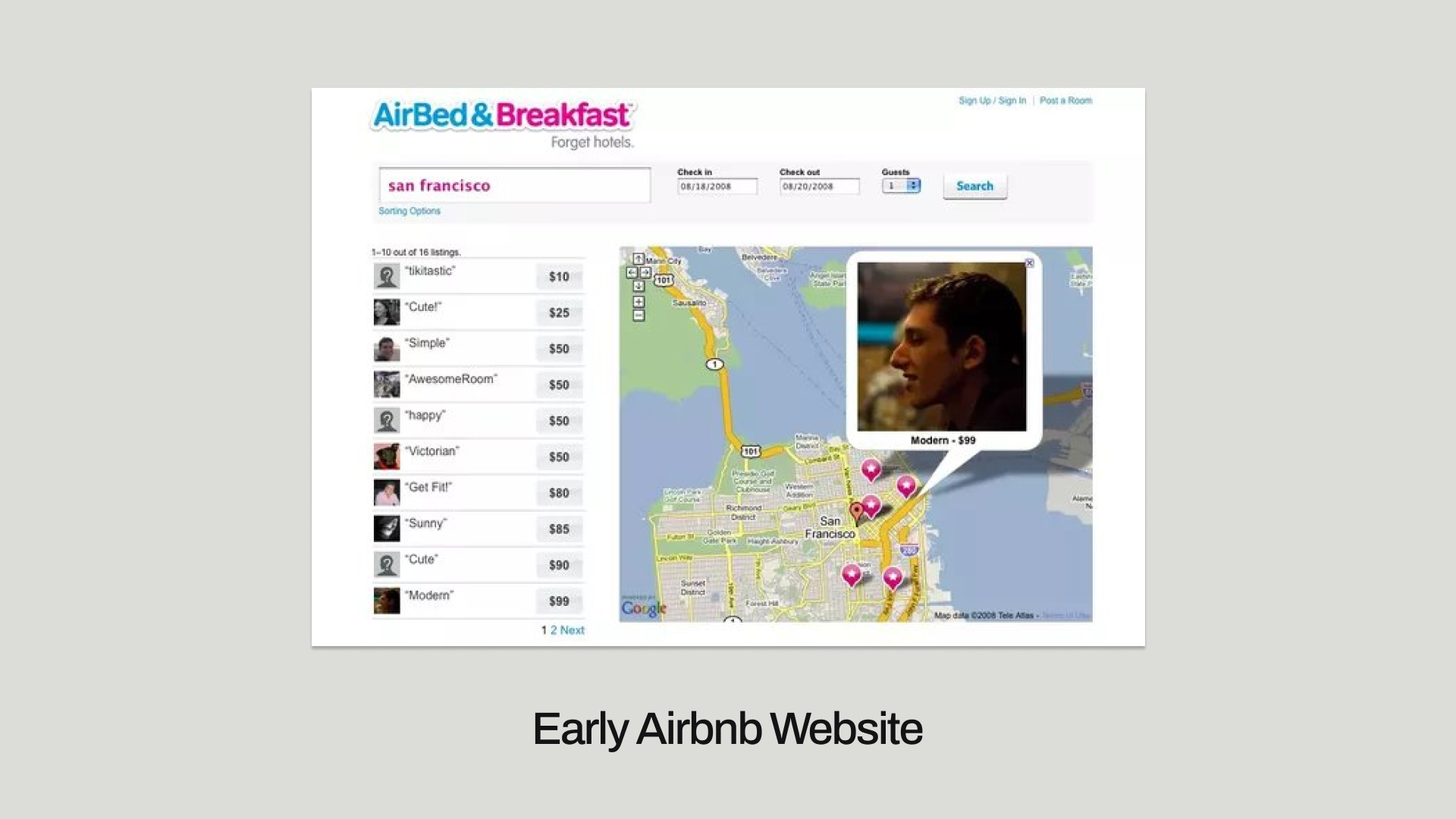

- Airbnb's counter positioning was to offer a cheaper alternative to hotels.

- This was achieved by allowing people to rent out their homes to travelers.

- This was a new business model that was different from what was currently available in the market.

- The barrier to entry for hotels was that it would be irrational for them to adopt the new model because it would destroy their existing business model.

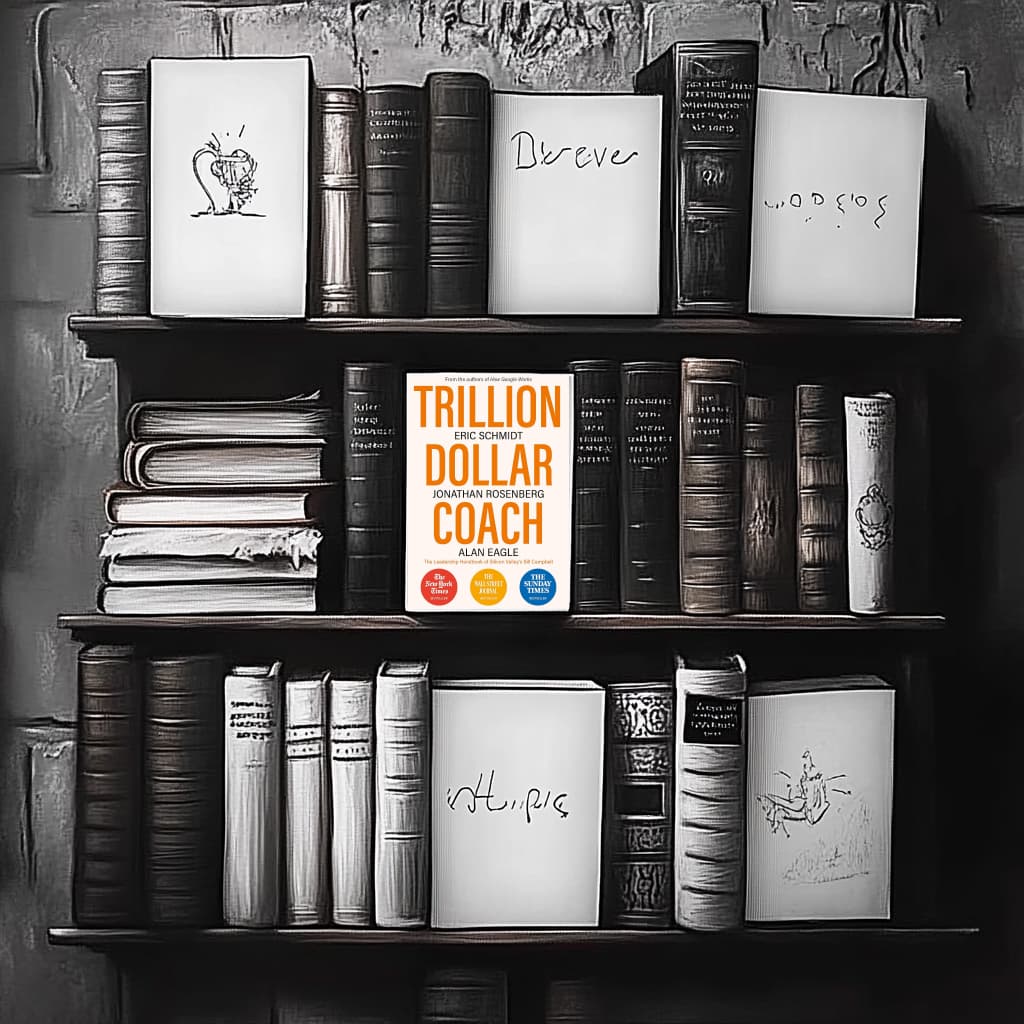

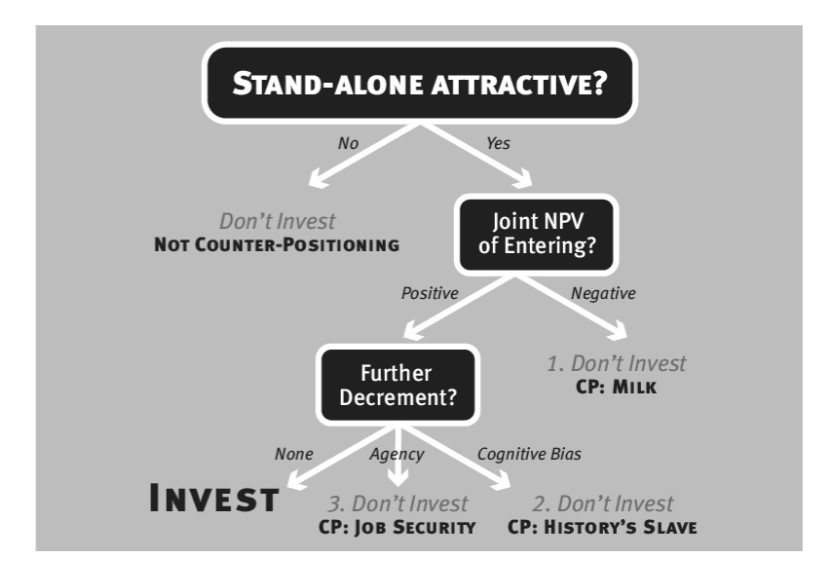

The above chart helps to determine if something is counter positioning. The first question is whether the business is attractive as a stand alone entity.

The second question is what is the joint net present value of entering the market or copying the new model. This framework helps to distinguish between a business that is counter positioning and one that is not.

Is the business attractive as a stand alone entity?

The first interesting question to assess whether something is counter positioning is to assess whether the incumbent business can adopt the new model as a stand alone entity. If they can't then it doesn't meet the criteria for counter positioning.

Example - Airbnb vs hotels

Airbnb introduced a model leveraging the sharing economy, allowing individuals to rent out their properties as temporary lodging. This platform-based approach significantly reduces the need for owning physical assets, setting Airbnb apart from traditional hotels, which rely on substantial investments in property and infrastructure.

On it's own merits, the Airbnb model is a stand alone business because it capitalizes on underutilized personal real estate, offering a new revenue stream without the overhead costs associated with traditional hotels. Hotels, meanwhile, cannot seamlessly adopt this model without conflicting with their core operations, which focus on service consistency and capital-intensive property management.

Of note, the hard thing about new business models is that they are often dismissed by incumbents as irrelevant or unsustainable. As the blog post from Paul Graham about Fred Wilson shows, Fred Wilson was skeptical about Airbnb's long-term potential to disrupt the hotel industry. However, Airbnb's counter positioning strategy proved successful, demonstrating the power of innovative business models in reshaping industries.

from: Paul Graham to: Fred Wilson date: Sat, Feb 14, 2009 at 9:50 AM subject: Re: airbnb

Did they explain the long-term goal of being the market in accommodation the way eBay is in stuff? That seems like it would be huge. Hotels now are like airlines in the 1970s before they figured out how to increase their load factors.

from: Fred Wilson to: Paul Graham date: Tue, Feb 17, 2009 at 2:05 PM subject: Re: airbnb

They did but I am not sure I buy that

ABNB reminds me of Etsy in that it facilitates real commerce in a marketplace model directly between two people

So I think it can scale all the way to the bed and breakfast market

But I am not sure they can take on the hotel market

I could be wrong

But even so, if you include short term room rental, second home rental, bed and breakfast, and other similar classes of accommodations, you get to a pretty big opportunity

fred

What is the joint net present value of entering the market?

The second question to ask is what is the joint net present value of entering the market or copying the new model. The 'joint' refers to both the incumbents existing business and a future business that would be created by adopting the new model.

An example of this would be

NPV Calculation Example for HotelCo in 2009

Given:

- Investment Required: $1,000,000

- Expected Annual Revenue from New Market: $200,000

- Discount Rate: 10%

- Time Horizon: 5 years

Step 1: Calculate Annual Net Cash Flow

Annual Net Cash Flow = Expected Revenue Annual Net Cash Flow = $200,000

Step 2: Calculate Present Value (PV) of Each Year's Cash Flow

Year 1: $200,000 / (1 + 0.10)^1 = 200,000 / 1.10 = 181,818 Year 2: $200,000 / (1 + 0.10)^2 = 200,000 / 1.21 = 165,289 Year 3: $200,000 / (1 + 0.10)^3 = 200,000 / 1.331 = 150,680 Year 4: $200,000 / (1 + 0.10)^4 = 200,000 / 1.4641 = 137,891 Year 5: $200,000 / (1 + 0.10)^5 = 200,000 / 1.61051 = 125,355

Step 3: Sum of Present Values

Total PV = $181,818 + 165,289 + 150,680 + 137,891 + 125,355 = $761,033

Step 4: Subtract Initial Investment

NPV = Total PV - Initial Investment NPV = $761,033 - $1,000,000 = $-238,967

Negative NPV

The NPV of entering the short-term rental market for HotelCo in 2009 is $-238,967. This negative NPV indicates that the expected cash flows from the new market do not cover the initial investment. Therefore, HotelCo should not enter the short-term rental market as it would result in a financial loss.

This ends up with the nickname "milk" as the CEO of the incumbent business is choosing to milk the existing business rather than invest in the new business model.

The Power of Startup Founders

This calculation set is interesting, as the initial investment is high at one million to build the platform. This calculation demonstrates the actual advantage that startup founders possess is that they are able to leverage this time that they have to work for not much money to build the product. Because they aren't paying themselves they are getting an enormous amount done at effectively zero cost.

An incumbent typically has to pay for the new business model and the existing business model. This is why it is so hard for them to adopt a new model. They typically have to hire a team and can't ask their existing team to work extra hours for free.

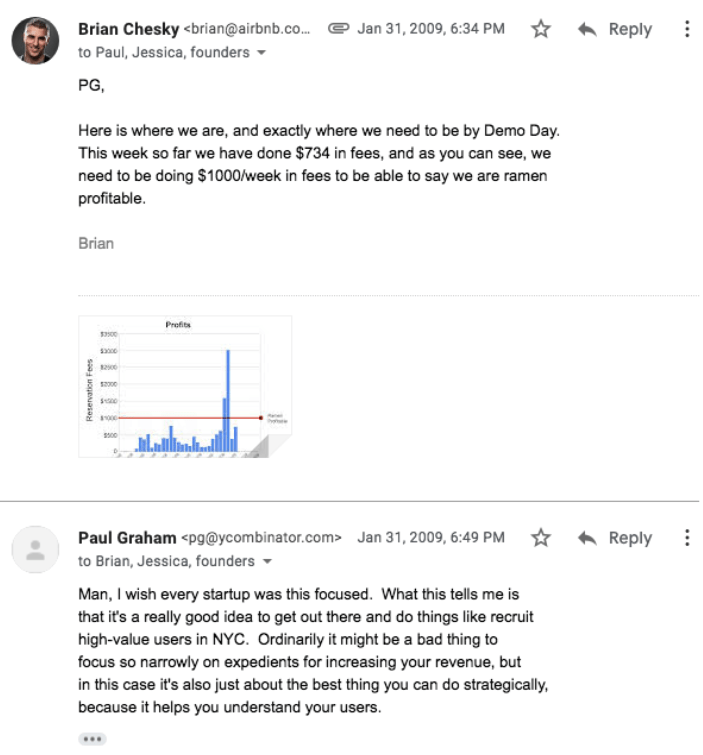

Let's compare that to how hard startup founders work as shown in this quote by Brian Chesky, in the early days of Airbnb:

The first thing Y Combinator did was create a structure for us to work on it full time and live together. So we were all working on it, but everyone had other things going on in their life. The enemy of a startup is everyone else's life. It's true. You have life, vacations, conferences, you go away, do other stuff and that's the enemy of start-up.

Paul Graham used to say, 'Start-ups don't die, they just fade away.' So, we decided, for three months, Nate would move from Boston to San Francisco and we'd wake up at 8:00, go to bed at midnight, and work from eight to midnight, seven days a week. In that dedication for three to four months, we created this serious rhythm where we weren't doing other things. We were focused.

| Description | Calculation | Amount |

|---|---|---|

| Annual Salary | $100,000 per person | $100,000 |

| Hourly Rate | $100,000 / 2,080 hours | $48.08 |

| Total Working Hours in 4 Months (per person) | 120 days * 16 hours/day | 1,920 hours |

| Total Working Hours for 3 People | 1,920 hours * 3 people | 5,760 hours |

| Total Cost for 3 People | 5,760 hours * $48.08/hour | $276,211.20 |

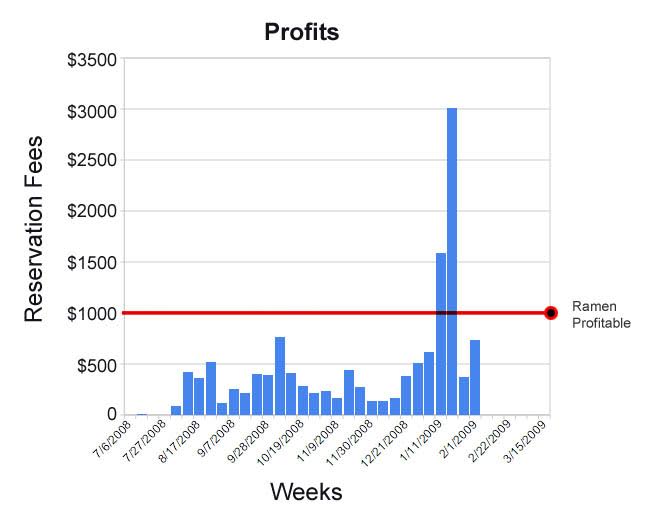

Now the interesting thing is that of course while they were doing this, they famously didn't have enough money at all. So they didn't pay themselves a salary. So even at a salary of $100k a year that would still be too high. There is this famous quote of Brian Chesky showing their early earnings in 2009.

Lets's compare this cost to the cost of hiring a team to build the platform for HotelCo.

| Description | Calculation | Amount |

|---|---|---|

| Hourly Rate for Consultants | $150 | $150 |

| Total Working Hours for 3 People | 1,920 hours * 3 people | 5,760 hours |

| Total Cost for 3 People | 5,760 hours * $150/hour | $864,000 |

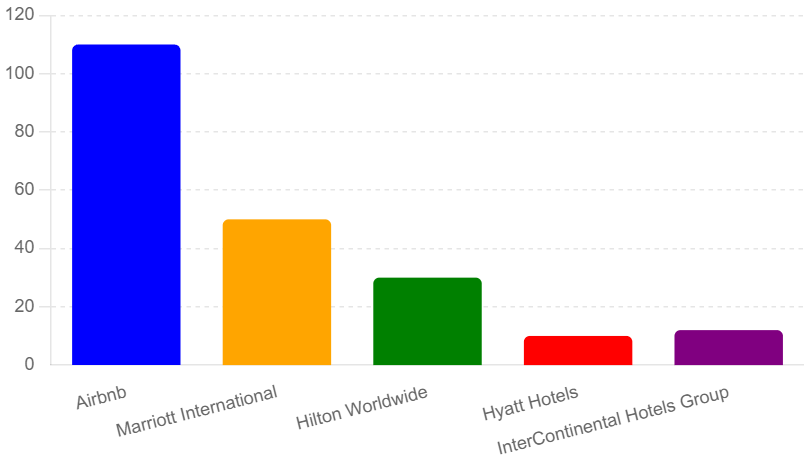

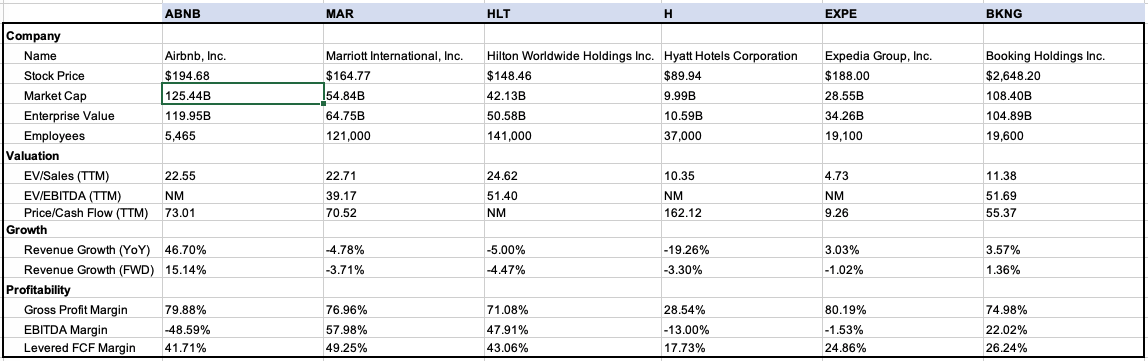

Crazy to think that now the market cap of Airbnb is greater than the Marriot and the Hilton combined!

History's Slave

The concept of being "history's slave" refers to the idea that individuals and organisations are often constrained by past experiences, established norms, and entrenched routines, which shape their perceptions and decisions. This historical inertia can make it challenging to recognise and adapt to novel approaches or disruptive innovations.

Together these two characteristics frequently lead incumbents to at first belittle the new approach, grossly underestimating its potential. In the face of low-cost passive funds, Ned Johnson of Fidelity once famously inquired, “Why would anyone settle for average returns?”

This negative cognitive bias can lead to a “don’t invest” decision, even if an objective observer might judge such an investment favorably.

Sticking to the familiar, CEOs become prisoners of their history, unable to break free from outdated modes of thinking and thereby potentially missing out on new opportunities for growth and improvement. This phenomenon is particularly evident when incumbents dismiss emerging competitors due to a reliance on past successes and an underestimation of the newcomer's potential.

Job Security & Agency Issues

Job security and agency issues frequently lead incumbent CEOs to avoid investing in new technology. The fear of disrupting a stable and successful business model can cause them to prioritize their personal job security over potential innovations.

This negative cognitive bias can result in a conservative approach, where the CEO opts for maintaining the status quo rather than embracing uncertain, yet potentially rewarding, technological advancements.

The perceived risk to their position makes them reluctant to take bold steps, even when an objective observer might see the value in adopting the new technology.

Surplus Leader Margin Calculations

The Surplus Leader Margin (SLM) for Counter-Positioning helps quantify the competitive advantage of a company with a superior business model over an incumbent. In this context, consider Airbnb as the challenger and a traditional hotel chain as the incumbent.

The SLM calculates the profitability of Airbnb when the hotel chain makes no profit. By comparing the variable costs, prices, and booking volumes of both businesses, we can see that Airbnb's lower costs and higher volume allow it to maintain profitability even at competitive prices.

This ability to sustain profit while forcing the incumbent to zero profit is a measure of Airbnb's strategic advantage.

In our example, Airbnb can generate 1.8 times the profit of the hotel chain under the same conditions. This significant margin demonstrates Airbnb's strength in the market, driven by its innovative business model that leverages lower costs and higher efficiency.

The takeaway about Surplus Leader Margin

The SLM highlights how new entrants like Airbnb can disrupt established industries by offering better value to customers while maintaining strong profitability. This metric is crucial for understanding the dynamics of competition and the strategic positioning of companies in various markets.

If you are counter positioning then shush!

To deter an incumbent, the challenger should avoid boasting about its superiority and instead adopt a respectful tone. This strategy leverages cognitive bias, potentially causing the incumbent to delay recognizing the threat, thus giving the challenger a head start in establishing its new business model.

Conclusion

Counter positioning is a powerful strategy that can help businesses differentiate themselves from their competitors and create a unique value proposition for their customers. By offering a new product or service that is different from what is currently available in the market, businesses can gain a competitive edge and create long-term value for their shareholders.

In this article we explored how Airbnb utilized counter positioning to differentiate itself from its competitors and create a new business model that disrupted the hotel industry. By offering a cheaper alternative to hotels, Airbnb was able to attract a new customer base and establish itself as a leader in the short-term rental market.

In the next article we will explore the concept of cornered resources and how it can be applied to Airbnb's rise to power.