The Exceptional Resources of Airbnb - 7 Powers Part 2

GET THE #1 EMAIL FOR EXECUTIVES

Subscribe to get the weekly email newsletter loved by 1000+ executives. It's FREE!

Introduction

Welcome to the second part of our series on Airbnb and the 7 Powers framework. In this article, we will explore the concept of cornered resources and how Airbnb leveraged these to become the dominant player in the short-term rental market.

Prior to reading this, make sure you read the first part of the series, where we discussed counter positioning and how Airbnb differentiated itself from its competitors by offering a new business model that disrupted the hotel industry.

This series explorers the 7 Powers book by Hamilton Helmer and apply the principles to real world examples, using Airbnb as a case study.

Part 1 - Definition: Cornered Resources

The book talks about how the power hurdle is high for a cornered resource. In order to qualify, an attribute must be sufficiently potent to drive high-potential, persistant differential return margins, with operational excellence spanning the gap between potential and actual.

A cornered resource refers to a unique and valuable asset within a company that provides a sustainable competitive advantage due to its rarity and difficulty to replicate.

To be classified as a cornered resource, it has to satisfy five key conditions:

- Idiosyncratic

- Non-Arbitraged

- Transferable

- Ongoing

- Sufficient

We will explore each of these conditions in detail.

Part 1a - Idiosyncratic

"If a firm repeatedly acquires coveted assets at attractive terms then the proper strategy question is 'Why are they able to do this?"

The book talks about an example of an oil company that can constantly find access to good oil fields. In this instance it would lead the observer to find that they have exceptional locating skills and that is their cornered resource.

The definition of idiosyncratic is traits peculiar to an individual or group. In the context of cornered resources, this means that the resources are unique to the firm and not easily replicated by competitors.

Example: The All Blacks Rugby Team

Photo by James Coleman on Unsplash

The All Blacks, New Zealand's national rugby team, are the most successful team in the history of sport, even though they don't have the highest-paid athletes. Their success is rooted in unique traits such as a culture of excellence, strong legacy, and innovative training methods.

These idiosyncratic elements, rather than merely the players' salaries or individual talents, are the Cornered Resources that give them a sustainable competitive advantage and set them apart from their competitors.

AirBnb Initial Rental House Acquisition

So what part of Airbnb was idiosyncratic?

In my opinion, their prime cornered resource is their team and their high quality housing stock. In the early days that it was their implementation of doing things that don't scale, that enabled them to get this housing stock onto their website.

This is a story from the early days of Airbnb and to how they acquired users as told on the Masters of Scale Interview

Brian Chesky: "Paul Graham asked us, Where’s your business? Where’s your traction?” And I go, “We don’t have a lot of traction.”

Paul Graham: People must be using it.

Brian Chesky: There are a few people in New York using it.

Paul Graham: So your users are in New York, and you’re still in Mountain View.

Brian Chesky: Yeah.

Paul Graham: What are you still doing here?

Brian Chesky: What do you mean?

Paul Graham: Go to your users. Get to know them. Get your customers one by one.

Brian Chesky: But that won’t scale. If we’re huge and we have millions of customers, we can’t meet every customer.

After this advice, they started acquiring properties and talking to customers directly.

But this isn't enough to make it a cornered resource, it has to be something that is hard to replicate. In comes photography. Brian talks about this in the interview:

The above advice is now known as Doing Things that Don't Scale and Paul Graham has written a fantastic essay on this.

"One of the most common types of advice we give at Y Combinator is to do things that don't scale. A lot of would-be founders believe that startups either take off or don't. You build something, make it available, and if you've made a better mousetrap, people beat a path to your door as promised. Or they don't, in which case the market must not exist. [1]

Actually startups take off because the founders make them take off. There may be a handful that just grew by themselves, but usually it takes some sort of push to get them going. A good metaphor would be the cranks that car engines had before they got electric starters. Once the engine was going, it would keep going, but there was a separate and laborious process to get it going. "

Paul Graham Do Things that Don't Scale

Takeaway

Airbnb demonstrated right from the outset an idiosyncratic approach to acquisition. I think it demonstrates that they were willing to go to any lengths to get a listing on their site and it sets the stage for the way that they were able to acquire more listings than any other platform.

By focusing all of their energy on the hosts, offering free photography and meeting them manually and trying to make it so that their customers loved them they were able to build a platform that was hard to replicate.

Part 1b - Non-Arbitraged

"What if a firm gains preferential access to a coveted resource but then pays a price that fully arbitrages out the rents attributable to this resource? In this case, it fails the differential return test of Power."

In the context of Airbnb’s early strategy, let’s delve into how their approach to acquiring high-quality property listings aligns with the non-arbitrage condition of cornered resources.

Cost Analysis and Differential Returns

Airbnb's initial strategy involved sending professional photographers to property listings, a service they offered for free. To evaluate whether this approach satisfies the non-arbitrage condition, we need to consider the costs involved and the differential returns generated.

Early Airbnb Office

- Cost of Service (C): The cost of providing professional photography, which includes labor costs, equipment, and travel expenses.

- Value Generated (V): The additional revenue generated due to enhanced listing appeal, resulting in higher booking rates and prices.

For Airbnb to satisfy the non-arbitrage condition, the value generated (V) must significantly exceed the cost of service (C).

Mathematically, this can be represented as:

Net Value(NV) = V - C

For non-arbitrage to hold, NV must be positive and substantial: NV > 0

Current Airbnb Office

Founders’ Labor and Opportunity Cost

In Airbnb’s case, the founders themselves often took on the role of photographers. This reduced the explicit costs associated with hiring professional photographers. However, to rigorously evaluate the non-arbitrage condition, we must consider the opportunity cost of the founders’ time:

- Explicit Cost (C_explicit): Direct costs like travel and equipment.

- Implicit Cost (C_implicit): Opportunity cost of the founders’ time, which could be represented as their forgone salary or the market rate for equivalent labor.

Thus, the total cost (C_total) can be expressed as: Explicit + Implicit

An Airbnb Italian Conference Room - that is styled to look like an Airbnb listing

Example Calculation

Assume the following:

- C_explicit: $200 per property (travel, equipment)

- C_implicit: $1000 per property (founders’ opportunity cost)

Therefore, C_Total = 200 + 1000 = 1200

If the value generated (V) per property due to higher booking rates and prices is $3000, then: NV = V - Total Cost = 3000 - 1200 = $1800

Since NV is significantly positive, Airbnb’s strategy satisfies the non-arbitrage condition.

Discussion

-

The above only represents an arbitrage opportunity if your platform exists for long enough to be able to recoup the costs. In this instance, there is some network effects at play here, we they are trying to spin the crank to get the platform to be able to become self sufficient.

-

This calculation actually helped me to realise why a founder and paying yourself very little represents an arbitrage opportunity. If the founders are willing to work for free then they can get a lot done for very little money. This is why it is so hard for incumbents to compete with startups. They have to pay for the new business model and the existing business model.

-

Interestingly, the downside though is that all of this work is meaningless if you go out of business. Probably why Paul Graham talks about how your number one thing to do is to ensure that you just don't die

You are therefore gaining a competitive advantage by being willing to work for free. Of course, this is not sustainable in the long term but it is a powerful tool in the early days of a startup.

Paul Graham has a fantastic essay on this Ramen Profitable

Part 1c - Transferable

"If a resource creates value at a single company but would fail to do so at other companies, then isolating that resource as the source of Power would entail overlooking some other essential complement beyond operational excellence."

The easiest example of this is the Obama O's and Cap'n McCain's cereal. This was a limited edition cereal that was sold by the founders of Airbnb to fund their startup. The cereal was a hit and they were able to raise $30,000 from it.

AirBnb Cereal - Source

I think the concept of being transferable is also why Y Combinator looks for founders that are Relentlessly Resourceful. This is because they are looking for founders that can take a resource and apply it to a different context.

Part 1d - Ongoing

"In searching for Power, a strategist tries to isolate a causal factor that explains continued differential returns. There may be many factors that proved formative in developing Power but whose contributions then became embedded in the business."

A key example of this is the fact that Brian Chesky and the Airbnb team managed to survive in 2020 despite the pandemic. They did this by pivoting to Online Experiences and Long Term Stays. This is a great example of how they were able to take their existing resources and apply them to a different context.

To be fair they did get a $1 billion loan from Silver Lake and Sixth Street Partners and they also had to cut 25% of their workforce. But the fact that they have rebounded so quickly is a testament to their ability to take their resources and apply them to a different context.

Given what they have been faced with, I would say that they have clearly demonstrated that they are able to consistently reimagine their business model and adapt to the changing environment, thus proving that they have ongoing cornered resources.

Brian talks about how formative providing high quality guarantees to owners to protect their houses against getting trashed was. I think this highlights the sort of things that you need to do in order to protect your cornered resources. You need to be willing to go to any lengths.

Part 1e - Sufficient

The final Cornered Resource test concerns completeness: for a resource to qualify as Power, it must be sufficient for continued differential returns assuming operational excellence.

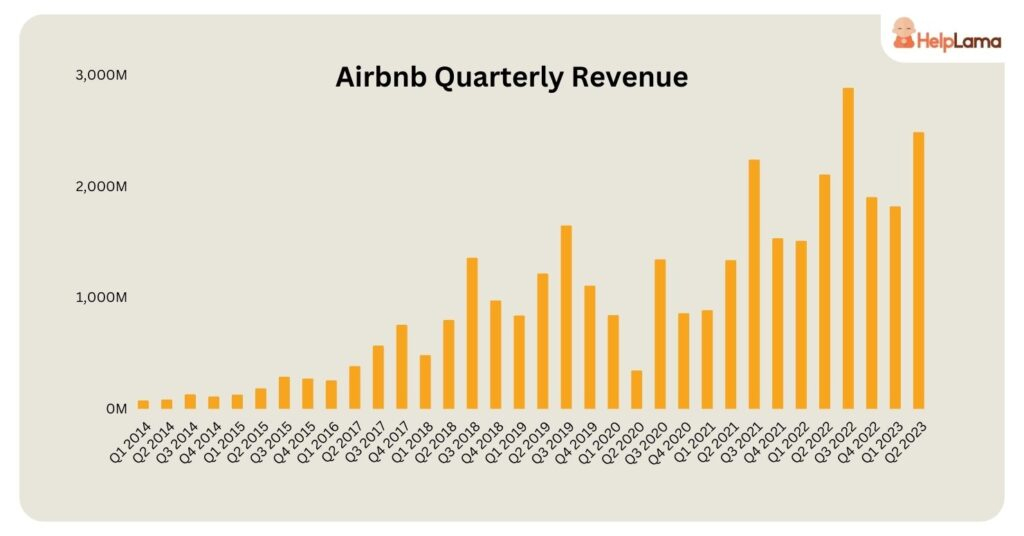

Airbnb Revenue Chart Source: Help Lama

Any company that is bigger than the other major hotel chains and can make $10 billion a year, increasing at 20% since last year with a graph like that seems to have a sufficient cornered resource.

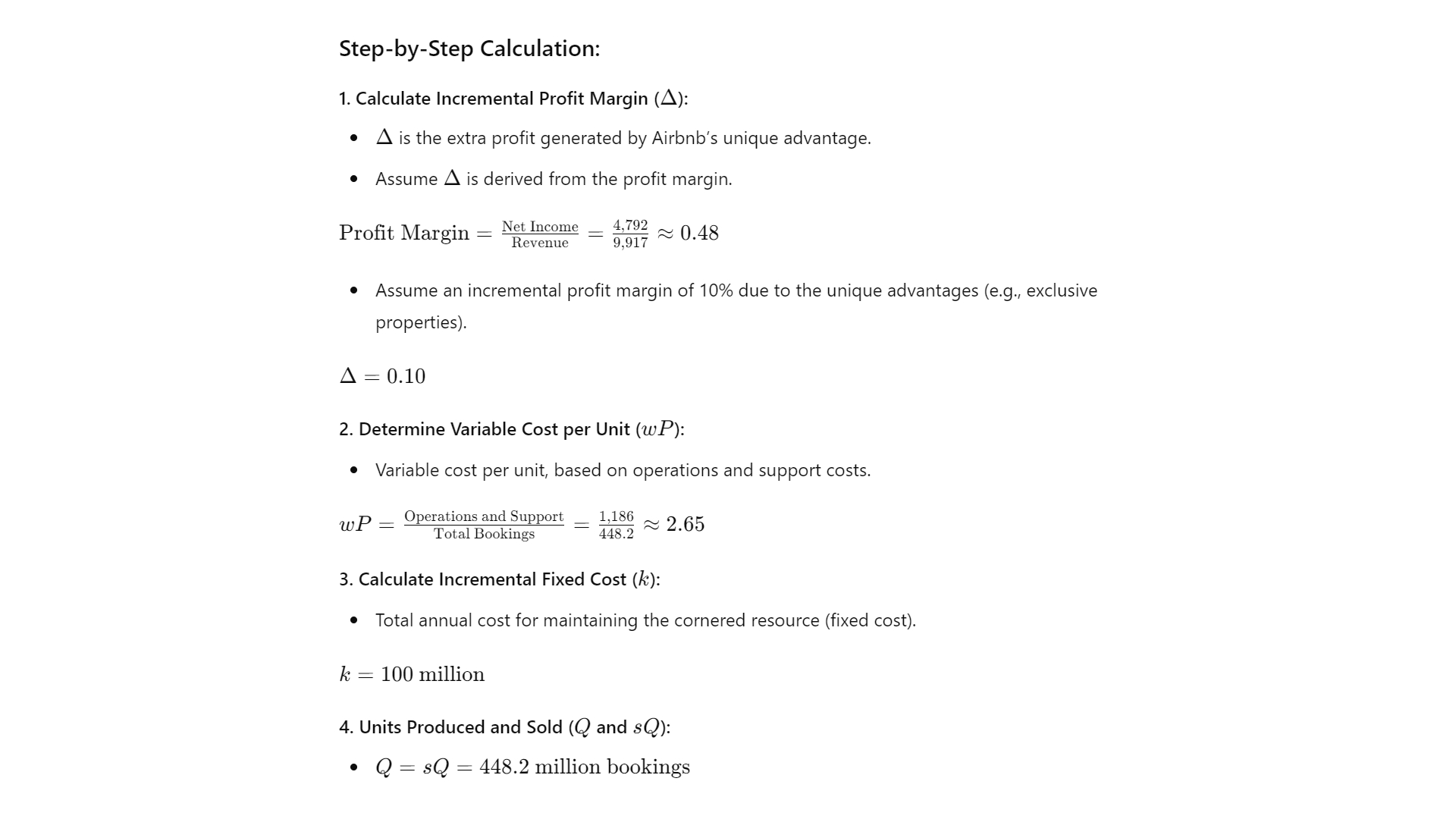

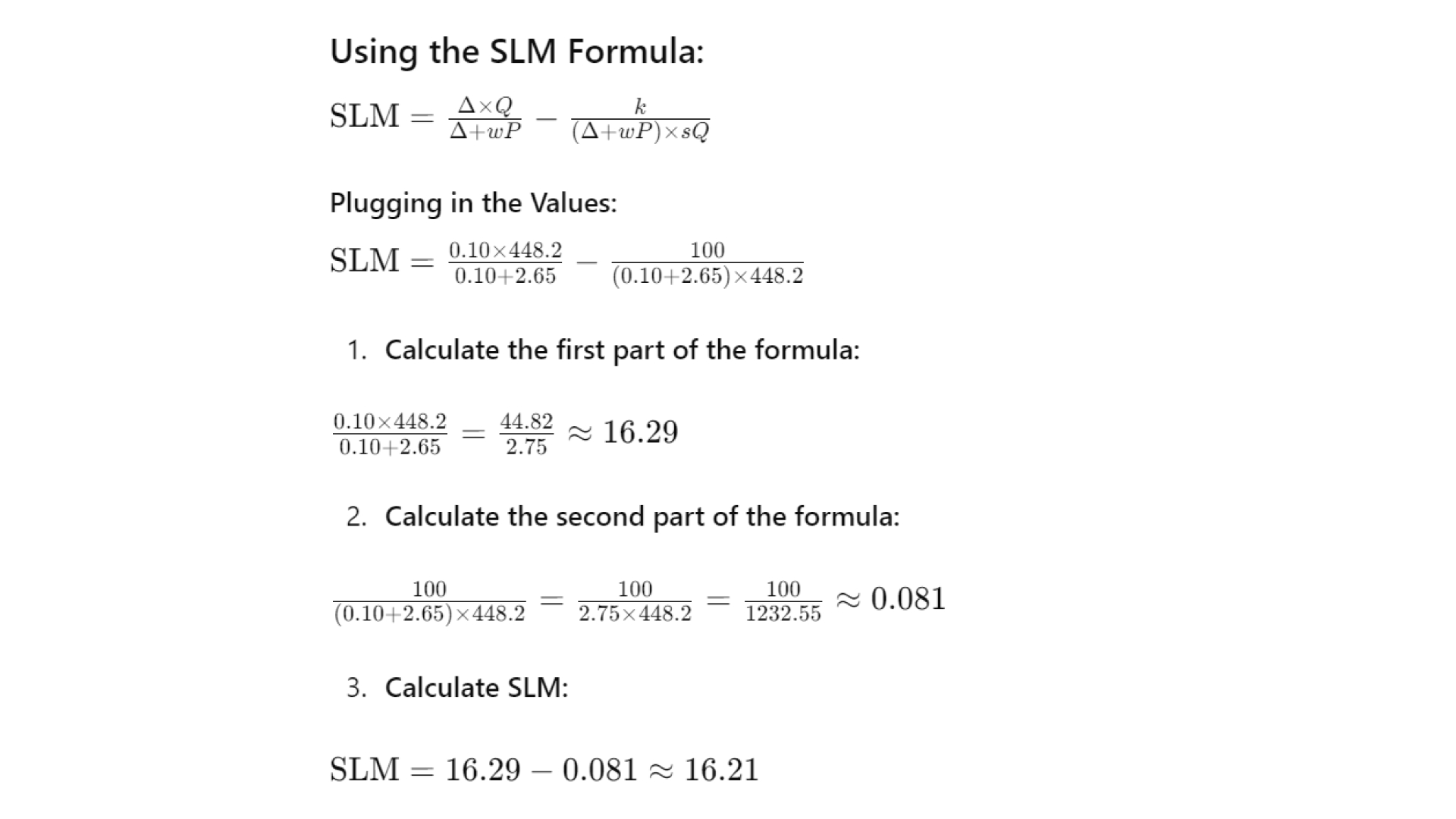

Part 2 - Financial Calculations

The end of the book has some calculations that dervie mathematically the power of a cornered resource. I will go through these using the latest Airbnb financials.

Total Bookings (Nights and Experiences Booked): 448.2 million

Revenue: $9,917 million

Total Costs and Expenses:

- Cost of Revenue: $1,703 million

- Operations and Support: $1,186 million

- Product Development: $1,722 million

- Sales and Marketing: $1,763 million

- General and Administrative: $2,025 million

- Total Expenses: $8,399 million

Net Income: $4,792 million

The Surplus Leader Margin (SLM) for Airbnb is approximately 16.21. This indicates that Airbnb's unique resources, such as exclusive properties and strong brand presence, provide an additional profit of $16.21 per booking after accounting for the costs of maintaining these advantages.